Tax on taxable income calculator

You pay taxes on the interest as if it were ordinary income that is at the same rate as your other income such as wages or self-employment earnings. So if youre in the 24 tax bracket you.

Taxable Income Formula Calculator Examples With Excel Template

Tax Tax Free Income.

. Estimate your federal income tax withholding. 15 Tax Calculators. It can be used for the 201314 to 202122 income years.

See how your refund take-home pay or tax due are affected by withholding amount. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

Tax Tax Free Income. This is your total annual salary before any deductions have been made. Ad We Put Money in Your Pocket-No Upfront Fee-Property Tax Appeal Experts.

More information about the calculations performed is available on the about page. That means that your net pay will be 40568 per year or 3381 per month. Income Tax after relief us 87A.

Enter your info to see your take home pay. For instance an increase of 100 in your salary will be taxed 3601 hence your net. On this page Which tax rates apply Before you use the calculator Information you need for this calculator What this calculator doesnt cover Access the calculator.

Your average tax rate is 217 and your marginal tax rate is 360. How It Works. Try Our Free And Simple Tax Refund Calculator.

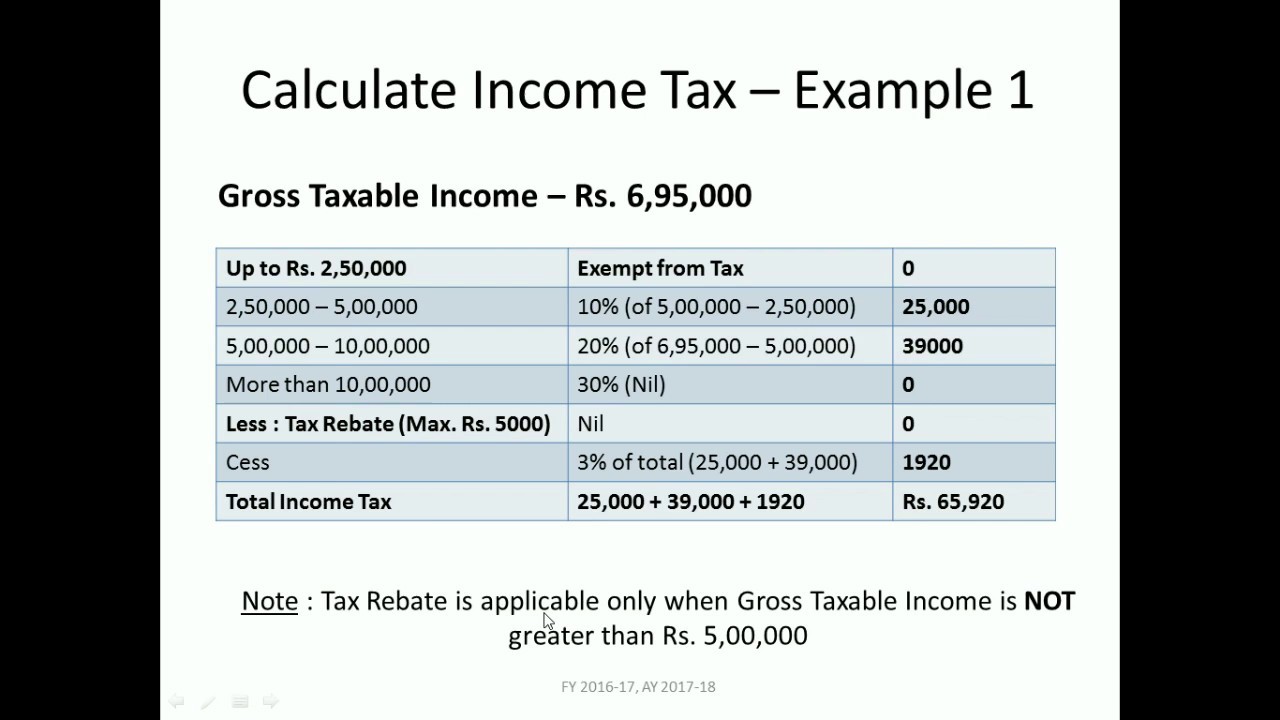

Ordinary. 2016-2017 2017-2018 2018-2019 2019-2020 2020-2021 pre. Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Base on our sample computation if you are earning 25000month your taxable income would be 23400. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions. Please enter your income deductions gains dividends and taxes paid to. In this case you will be charged 10832 in tax for the year 2022.

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Look into the income tax table and determine your salary column.

But there are plenty of other rules exceptions caveats deductions and loopholes that affect rental property taxes beyond how passive income. This marginal tax rate means that your immediate additional income will be taxed at this rate. Choose an estimated withholding amount that works for you.

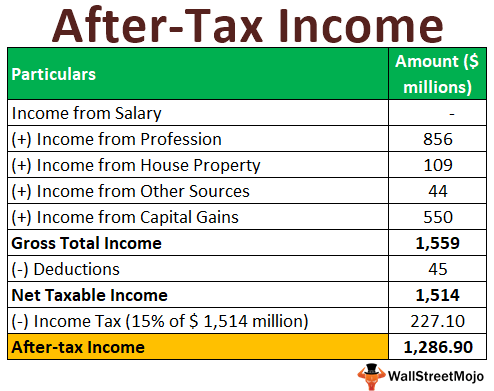

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Income Filing Status State More options After-Tax Income 57688 After-Tax Income Total Income Tax. The Federal or IRS Taxes Are Listed.

This marginal tax rate means that your immediate additional income will be taxed at this rate. 2022 free Canada income tax calculator to quickly estimate your provincial taxes. Federal California taxes FICA and state payroll tax.

In other words your marginal tax rate will be 339 while your average tax rate will be 197. This will reduce your net income to 44168 for a calendar year and you will receive 3681 as a salary. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Updated for 2022 tax year. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. Calculate your total income taxes.

Click here to view relevant Act Rule. The Oregon Tax Estimator Lets You Calculate Your State Taxes For the Tax Year. After getting your taxable income or salary take a look at the income tax.

Effective tax rate 172. Male Female Senior Citizen. Use this tool to.

Your average tax rate is 220 and your marginal tax rate is 353. After salary sacrifice before tax Employment income frequency Other taxable income. Other taxable income frequency Annually Monthly Fortnightly Weekly Financial year.

Ad Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. That means you pay taxes on it at your regular income tax rate between 10-37 of your income. Simple tax calculator This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2022. 100 Accurate Calculations Guaranteed. As a general rule the IRS classifies rental income as passive income and taxes it accordingly.

Calculation Of Personal Income Tax Liability Download Scientific Diagram

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax On Salary With Payslip Example Income Tax Excel Calculator Youtube

Income Calculator With Taxes Hot Sale 60 Off Www Wtashows Com

Excel Formula Income Tax Bracket Calculation Exceljet

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Calculator With Taxes Store 58 Off Www Wtashows Com

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Income Tax Fy 2020 21 Examples New Income Tax Calculation Fy 2020 21 Youtube

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Income Tax Formula Excel University

Income Calculator With Taxes Online 51 Off Www Wtashows Com

Income Calculator With Taxes Online 51 Off Www Wtashows Com

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Formula Excel University

How To Calculate Tax On Income Sale 50 Off Www Wtashows Com